Schedule of Filing and Submission of Annual Income Tax Returns

| Particulars | Individuals | Corporations Partnerships Cooperatives |

| BIR Forms | 1701 1701A | 1702RT 1702EX 1702MX |

| Date of Filing and Payment | 15-Apr-21 | 15-Apr-21 |

| Mode of Filing the Returns | eBIRForms EFPS | eBIRForms EFPS |

| Mode of Paying Income Tax Due | OTC thru AAB/ ePAY EFPS | OTC thru AAB/ ePAY EFPS |

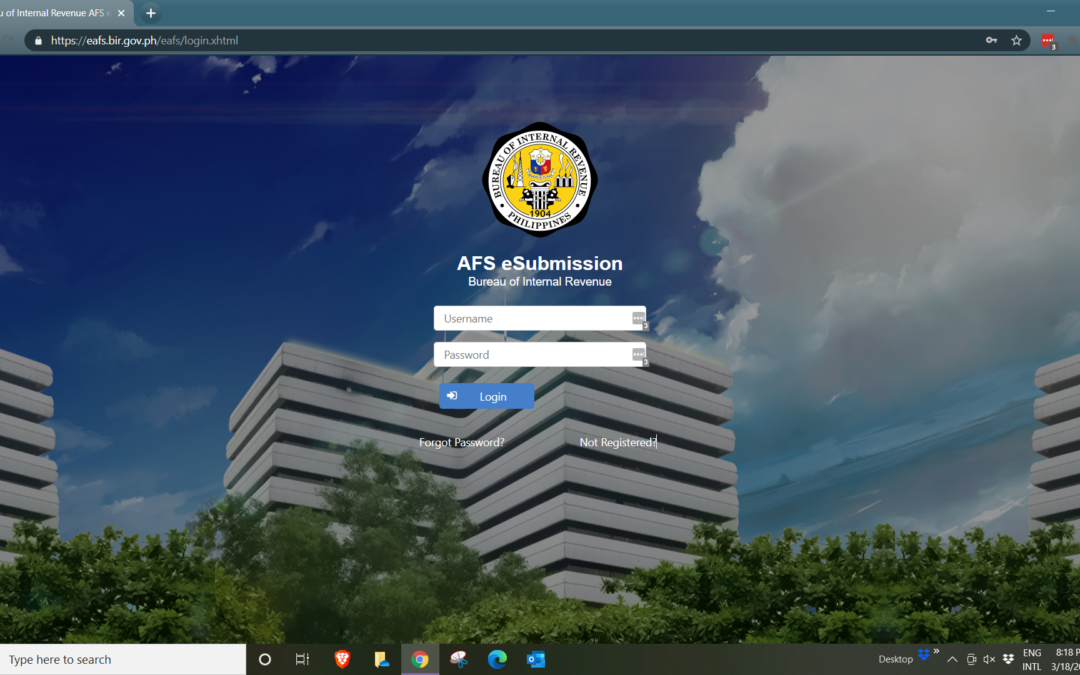

| Mode of Submission of Required AFS | OTC thru AAB/ eAFS | OTC thru AAB/ eAFS |

Schedule of AFS Submission to the Securities and Exchange Commission

All corporations with fiscal year ending December 31, including branch offices, representative offices, regional headquarters and regional operating headquarters of foreign corporations, shall enroll and file their AFS through the SEC Online Submission Tool depending on the last numerical digit of their SEC registration or license number in accordance with the following schedule:

| SEC License Number Ending | Due Dates |

| 1 | June 1 to 30 |

| 2 | July 1 to 31 |

| 3 & 4 | August 1 to 31 |

| 5 & 6 | September 1 to 30 |

| 7 & 8 | October 1 to 31 |

| 9 & 0 | October 1 to 31 |

Basic Set of Financial Statements to be Submitted to BIR and SEC

| Particulars | BIR | SEC |

| Annual Income Tax Return (ITR) | Yes | No |

| SEC Cover Sheet for AFS | No | Yes |

| Audit Report [Treasurer’s Cert.) | Yes | Yes |

| SMR for ITR | Yes | Yes |

| SMR for Financial Statements | Yes | Yes |

| Basic Set of Financial Statements | Yes | Yes |

Please share this post and like our page for future updates.