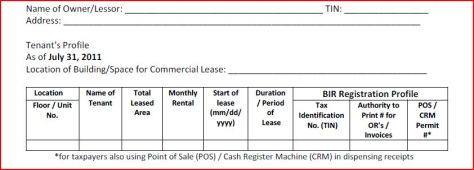

Lessors are reminded to monitor and submit to BIR a semi-annual Lessee Information Sheet (see image below) as prescribed by Revenue Regulations No. 12-2011 issued on July 25, 2011.

The required Lessee Information Sheet (report), which shall be under oath, shall indicate the following information:

- Building/space lay-out of the entire area being leased with proper unit/space address or reference;

- Certified true copy of contract of lease per tenant; and

- Lessee Information Statement (indicating the registered name of tenant, TIN, ATP for official receipts and invoices, and POS/CRM permit number, leased area, monthly rental payment, and period of lease)

The Lessee Information Sheet shall be submitted every 31st of January (for tenants as of December 31st of the previous year) and 31st of July (for tenants as of June 30th of the current year).

The Lessee Information Sheet shall be submitted in hard and soft copies (excel format stored in a CD-R) to the Revenue District Office (RDO) where the commercial establishment, building or space is located.

BIR will use the information submitted by lessors to validate the registration profile of the lessees. The information will also be used for future audit and investigation activities to validate the revenues reported by the lessors.

Penalty provisions. Lessors who fail to submit the reportorial requirements, or who willfully provide false information shall be subject to penalties under Sections 255 and 267 of the Tax Code. The regulations also mention that lessors who knowingly transact with taxpayers who are not registered with BIR will also be penalized.

Action points for LESSORS:

1. Lessors should therefore maintain and update the database of required information from their lessees.

2. Report accurate information to avoid future issues in tax examinations.

3. To ensure correctness of the information provided, you are advised to request for the source documents (copy of BIR registration, etc.)

4. Ensure the DST on the lease contract has been paid and proof is available.

5. Advise lessees who are unregistered to process their registration before the semiannual due dates for submission of the Lessee Information Sheet.

Action points for LESSEES:

1. Ensure that the information to be reported by the lessor on your company is accurate. These may be used against any future tax examinations.

2. Process your BIR registration if not yet registered.

Download: RR 12-2011